► The latest Brexit car industry news

► The challenges facing the sector…

► …and car makers’ plans for the future

The boss of Bentley Motors has warned that the added cost of a hard Brexit would slice a quarter off the car maker’s profits worldwide – and admitted that a last-minute deal with the EU was at the top of his Christmas wishlist.

Speaking the week before Christmas, chairman and CEO Adrian Hallmark said: ‘I sincerely hope some kind of common ground can be found in these last days of negotiations with the EU to find a credible trade deal. While a hard Brexit would not kill us, it would dent our profitability and make us less competitive. It would slow us down with component supply. But we are prepared as we can be.

‘We used to run with two days of stock around the factory. Today we have 14. By the middle of January it will be 20. One German journalist called me a squirrel – and I took that as a compliment! We will have almost four weeks of production components in stock so we’re ready. We have a parachute, a safety mechanism.’

Will cars be more expensive in a no-deal Brexit?

Undoubtedly, said Hallmark, who explained the additional costs manufacfturer like Bentley would face. ‘Consider the increase of cost of parts coming in, 2.5% to 4.5% duty on parts, plus the 10% tariff that goes on to the vehicle when it lands in Europe. The 2.5% to 4.5% puts a cost increase on every car across the world, and the 10% tax increase puts a 10% cost increase to the customer in Europe. If we absorbed all that incremental cost it would cost us about a quarter of our global profits.

‘If we passed it all on, it would cost us 20% of our profits, because we sell 24% of our cars to Europe – and when you work it all through, the total cost on every car going up and the tax on that car, that’s where we would be. So we either lose volume because we put prices up or we maintain volume and lose contribution because we’ve taken more cost on. We did multiple scenarios to find the least worst combination of pricing and cost, then further restructuring activity and then how can we mitigate? We can’t cover it all, but we must make sure what’s left doesn’t kill us.’

Further reading around Brexit

The latest Brexit-related car industry news

Four years after the referendum, the shockwaves of Brexit are still being felt across the UK car manufacturing sector. Factories across the land are already suffering from the dramatic fall in investment. Honda has confirmed that it will close its sole UK car factory in Swindon, with the loss of 3500 jobs from 2021, when the current lifecycle of cars like the Civic produced there come to an end.

Katsushi Inoue, chief officer for regional operations, pointed to ‘unprecedented changes’ affecting the industry, and that ‘it is vital that we accelerate our electrification strategy and restructure our global operations accordingly.’ Inoue also said that the decision ‘has not been taken lightly and we deeply regret how unsettling this announcement will be for our people.’

Nissan, too, pulled the next X-Trail from its production plans in the UK, reversing a 2016 pledge to build the seven-seater SUV in its Sunderland factory in the north-east, but it wrote to staff in spring 2019 admitting it would no longer manufacture the X-Trail in Britain. The model will now be made in Kyushu, Japan instead and Nissan admitted in the letter that Brexit was damaging its long-term investment plans. It said ‘the environment for the car industry in Europe has changed dramatically’ since the original decision in 2016.

Ford is on record saying that a no-deal Brexit would be ‘catastrophic’ for the UK arm of its business and all car makers are considering the future of their UK plants.

Brexit affects all car makers – including those which don’t manufacture in the UK. Porsche told the BBC that it may have to charge up to 10% more on the list price of cars it sells in the UK post-Brexit, owing to customs duties and other ancillary costs of dealing with a country cast out from the EU trading zone.

How could a no-deal Brexit cripple UK car production?

It’s clear the UK’s automotive industry is under serious threat from the ‘wrong’ Brexit. So what could happen to car companies, to dealers and to the cars we buy when we exit the EU on 31 December 2020?

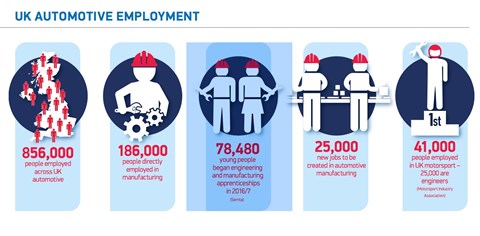

Right now, unless the government somehow appeases everyone and scores a great deal from the EU, it’s looking pretty gloomy, especially for the 856,000 employed in the business across the UK.

UK car manufacturers like borderless trading with the EU. Their web of supplier networks across Europe involves an estimated 1100 trucks crossing the Channel each day, bringing parts straight to the assembly line at factories in Sunderland, Cowley, Halewood, Swindon or one of the other 32 vehicle manufacturing plants in the UK. It’s a delicate operation that any border stoppages would disrupt in a major way.

A no-deal withdrawal will mean no transition period. That’ll throw sand into the slick parts delivery system from Europe and could stop production lines dead. ‘It’s becoming more and more difficult to justify investment in the UK because of the uncertainty,’ Jaguar Land Rover boss Ralf Speth (below) told CAR at the Paris motor show.

‘Every day we build around 3000 cars in the UK. That’s about 25 million parts. If we miss just one part, we cannot build a vehicle… and stopped production will cost us £60m a day.’

How angry are car company bosses?

Very. After the vote in 2016, car companies were sanguine, saying they respected the wishes of the people and would await the outcome of negotiations. Two years on and faced with the ‘total ineptitude’ of the government negotiators, as one analyst put it, the usually mild CEOs are baring their teeth.

‘Hard Brexit is a red line,’ Steve Armstrong, CEO of Ford of Europe, said in a recent statement. ‘It could severely damage the UK’s competitiveness and result in a significant threat to much of the auto industry, including our own UK manufacturing operations.’ He hinted that could mean shutting down its two engine plants (Bridgend and Dagenham). ‘We will take whatever action is necessary to protect our business in the event of a hard Brexit.’

BMW has said it could take some Mini production out of Oxford and transfer it to the Netherlands, and JLR’s Speth has warned it could take planned investment into electric cars elsewhere. In addition, BMW was so worried it brought forward the annual summer shutdown of its Mini plant in Cowley to 1 April 2019, a few days after the original Brexit deadline. ‘While we believe this worst-case scenario is an unlikely outcome, we have to plan for it,’ a BMW spokesperson said at the time.

Why will manufacturers pull out of the UK?

There’s no way of knowing how serious the manufacturers are when they talk of pulling production in the event of a no-deal, although the closure of Honda’s Swindon factory is proof they’re not bluffing. But we do know that a no-deal and immediate switch to World Trade Organisation (WTO) rules – with 10% import tariffs – will hurt car makers shipping to or from the EU. ‘Profit margins in our industry are significantly lower than 10%. These extra costs will either be passed on to the consumer or will have to be absorbed by the manufacturers,’ said Erik Jonnaert of the car makers’ European lobbying association, ACEA. ‘That will put the competitiveness of our operations under threat,’ Toyota Motor Europe CEO Johan van Zyl said.

The wrong Brexit deal would give manufacturers the excuse they need to up sticks and leave, particularly given our weaker labour laws compared to France or Germany. ‘It’s easy to get rid of people in the UK, so it’s easy to pull out of,’ said David Bailey, professor of business at Aston University. ‘I’m not saying that’s going to happen when models are mid-cycle, but when they are being replaced that’s when manufacturers make those locational choices.’

Which car plants could close?

The following car factories are believed to be at risk of closure in a worst-case scenario:

- Ellesmere Port (above), where Vauxhall makes the Astra, a model hit by the firm’s reduced focus on fleet sales.

- Ford’s Bridgend engine plant. Loses JLR as a customer in 2020.

- JLR’s Castle Bromwich plant. Currently on a three-day week after the popularity of Jaguar models made there slumped.

Honda’s Swindon plant was on the watch list, but has now had the chop confirmed. It chances of survival had been revived by the introduction of the current Civic, but the threat of export tariffs were too much for Japan to stomach.

What will a no-deal Brexit do to car sales?

A no-deal scenario will badly hit already weakening car sales, according to market analysts LMC Automotive. The firm believes can and van sales would continue to fall, bottoming out at 2.55 million in 2020, compared to three million in 2016.

On the other hand, if we manage to negotiate a nice free-trade agreement involving an orderly transitional period, that would be enough to halt the sales slide next year and increase demand to 2.81 million by 2021. The difference between the two potential 2020 figures is huge: 270,000 vehicles.

Will our post-Brexit air be dirtier?

One of the many Brexit unknowns is whether we’ll remain in Europe’s average CO2 agreement, which fines manufacturers that don’t hit targets for average emissions across their range.

‘If the UK dropped out there would be no reason for manufacturers to sell plug-in vehicles in the UK because they would no longer count to CO2 targets,’ said Greg Archer of green pressure group Transport & Environment (T&E). ‘That would create a shortage.’

Manufacturers might be more willing to sell us less-fuel-efficient engine options, some of which have already been canned, knowing it wouldn’t impact their overall EU score.

Are there any reasons to be cheerful?

Well, although new-car sales are down, it’s not by much – dealers have been saved by the mass migration to finance, which has softened the blow of the price rises on Eurozone imports caused by the weak pound. This pattern is likely to continue after Brexit. Daksh Gupta, CEO of the Marshall Motor Group dealership chain, said: ‘Customers are used to paying the £300 a month. They like the idea of PCP.’ They just don’t get quite as much for their £300 as they used to.

‘They’ve come down a model or even migrated across brands. They’re still buying the cars, but the richness is decreasing,’ he said. That’ll get worse in a no-deal scenario – another 10% will be wiped off the pound’s value again if we leave with no deal, LMC predicts. So although we’ll still buy cars, we just won’t get as much for our money. Not very cheerful after all then.

Read on for our earlier news and background information on Brexit.

Brexit and the UK car industry: the background and earlier news analysis

The auto industry is under attack from all sides:

- Brexit uncertainty, hitting investment and sales

- Weaker consumer demand, registrations falling

- WLTP emissions regulations disrupting production

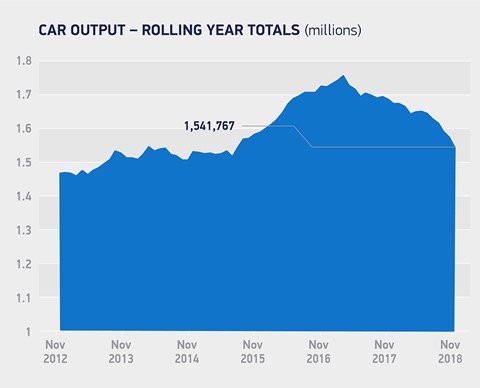

Great Britain plc has enjoyed a strong few years of production, peaking at nearly 1.8 million units in 2017; but as the SMMT graph below demonstrates, that’s quickly sliding as political uncertainty bites:

‘It’s very concerning to see demand for UK built cars decline in November, with output seriously impacted by falling business and consumer confidence in the UK allied to weakening export markets,’ Mike Hawes, SMMT Chief Executive, said last autumn.

‘With fewer than 100 days until the UK leaves the European Union, the automotive industry needs certainty and a ‘no-deal’ Brexit must be ruled out. Thousands of jobs in British car factories and supply chains depend on free and frictionless trade with the EU – if the country falls off a cliff-edge next March the consequences would be devastating.

Car bosses queue up to warn over Brexit

The boss of Jaguar Land Rover has already warned that uncertainty over Brexit negotiations is putting £80 billion of future investment at risk. Chief executive Ralph Speth said that JLR was reconsidering its future options as it prepared for a worse-case scenario of no deal being struck over the UK’s exit from the EU.

‘A bad Brexit deal would cost Jaguar Land Rover more than £1.2bn profit each year,’ Speth warned. ‘As a result, we would have to drastically adjust our spending profile. We have spent around £50bn in the UK in the past five years – with plans for a further £80bn more in the next five. This would be in jeopardy should we be faced with the wrong outcome.’

He added that the company’s ‘heart and soul is in the UK,’ but in an interview with the Financial Times he admitted that JLR would consider closing UK factories if necessary. ‘If I’m forced to go out because we don’t have the right deal, then we have to close plants here in the UK and it will be very, very sad. This is hypothetical, and I hope it’s an option we never have to go for.’

JLR joins the chorus of different manufacturing giants warning about the perils of a no-deal solution, which could add tariffs and red tape for a complex, multi-national car making industry that relies on frictionless movement of people and parts to build cars in Britain.

Mini (above) has also warned that uncertainty over Brexit is damaging its business.

It’s not just damaging manufacturers: why importers are at risk too

We caught up with Paul Philpott, the CEO and president of Kia Motors UK. ‘We import 55% of our cars from Slovakia, the other 45% from Korea, and are worried about how we get cars and parts into the UK. What are the implications of tariffs to my business? What regulatory changes might we face? The honest answer is, until a deal is done we just don’t know.’

He warned that this ongoing uncertainty was damaging to business. ‘There’s just no clarity – it’s really hard to plan for all the different scenarios. If this uncertainty goes beyond November, we will be in trouble.’

Kia normally holds around 7000 cars in stock across the dealership network, Philpott (above) said. ‘And we can store an additional 15,000 cars at the Immingham docks [where Kia imports cars in Lincolnshire]. We can store over 20,000 cars, or around two months’ stock and are considering how much we need to do this to balance the risk from Brexit.’

Manufacturers, importers, dealers and others in the supply chain all face an anxious wait for a deal to be done.

More car industry news