► New tax disc system from April 2017 for new cars

► Existing cars will use today’s CO2 brackets

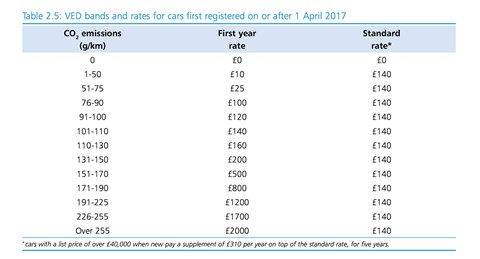

► From 2017 new cars pay ‘standard’ or ‘premium’ tax

► 95% of motorists will pay £140 a year ‘standard rate’

► ‘Premium’ cars over £40,000 will carry a £310 supplement for five years

► Dirtiest cars to pay £2000 in first year

► New ‘premium car tax’ for vehicles over £40,000

► VED ringfenced to pay for new roads, repairs

► MOT tests only applicable after four years

The Chancellor George Osborne today announced the Summer 2015 Budget – and pledged to overhaul the UK’s car taxation system, with a ‘premium’ car tax to clobber pricier vehicles over £40,000. The CO2-based set-up has existed for a decade but is increasingly out of kilter with reality, as modern cars’s emissions continue to fall to a lower level – meaning many qualify for next-to-no road tax every year.

A new sliding scale will be launched in April 2017 to reset the threshold for different Vehicle Excise Duty (VED), the annual ‘tax disc’ which every licensed vehicle on the roads must pay in Britain. It was the key change announced in the Summer Budget on 8 July 2015. Read on for the key announcements made today by the new Conservative Government.

July Budget 2015 at-a-glance: how it affects motorists

Road tax overhauled

Vehicle excise duty will be radically changed to keep pace with the falling CO2 emissions of modern cars. Osborne claimed that over three quarters of new cars would pay no VED at all in their first year if the current system continued by 2017 as cars continued to clean up. His new system changes all that. The first year’s tax for new vehicles registered after April 2017 will still be directly linked to CO2 emissions, but in subsequent years there will be just three rates: zero-emissions (free), standard (a flat rate of £140 applying to 95% of cars on the roads today) and premium (a supplement of £310 a year for cars over £40,000 list price new). The changes apply only to new vehicles registered after 2017: all existing cars on the roads will pay at today’s rate, typically an average of £166.

Electric cars remain tax-free

Electric vehicles won’t pay any road tax at all, giving them a distinct advantage over petrol and diesel models. The Government is keen to support EVs and make Britain a hotbed of electric car tech.

Premium car tax introduced

But while electric cars benefit, premium cars will suffer: the Government has spelled out a new premium car tax for new vehicles with list prices over £40,000 registered after April 2017. They will be clobbered by an additional £310 VED charge every year, and this will be based on price not emissions after the first year. This will surely spell the end of hybrid Range Rovers and the like dodging VED.

VED ringfenced for new roads, pothole fixing fund

The money brought in from road tax in England will be spent on England’s roads from 2020-21. The Chancellor said four-fifths of all journeys in the UK are made on roads, but admitted ‘we rank behind Puerto Rico and Namibia in the quality of our network.’ Osborne pointed out that France has built more than 2500 miles of new autoroute in the past 25 years while the UK had built just 300; this long-term structural failure to invest in Britain’s road network will be addressed by a new fund, ringfencing the money from VED to pay for more roads and repairs. ‘From the end of this decade, every single penny raised in Vehicle Excise Duty in England will go into that fund to pay for the sustained investment our roads so badly need,’ the Chancellor said.

MOT changes: now after four years

The government will extend the deadline for the first MOT of new cars and motorcycles from three to four years, subject to consultation. The Government claims this will save UK motorists £100 million annually.

Company car tax

Company car tax rates for 2019-20 will continue to be based on a percentage of list price, but the tax will increase by 3% for cars emitting more than 75g/km of CO2 from 2019-20 – up to a maximum rate of 37%. The cleanest company cars will have to emit 0-50g/km of CO2, with further bands at 51-75g/km and 76-94g/km.

Fuel duty: no change

Good news – no more unplanned rises in pump prices. ‘I can also confirm that there will be no changes to the plans for fuel duty I set out in March [2015] – fuel duty will remain frozen this year.’

Insurance Premium tax goes up

From November 2015 the standard rate of Insurance Premium Tax will be increased from 6% to 9.5%. This will inevitably put upwards pressure on drivers’ insurance policies.

Read on to find out what was announced in the March 2015 Budget and how that affects motorists.

March 2015 Budget: what drivers need to know

► UK Budget 2015 live coverage

► Petrol duty frozen for fifth year

► 0.5p-a-litre Sept increase scrapped

► Little change in company car tax

► Severn toll crossing reduced

► 5p cheaper fuel in rural areas

► Tax-exempt classic cars from 1976

► £100m fund for autonomous cars

The Chancellor George Osborne announced the abolition of planned fuel duty increases in the 2015 Budget, claiming the accumulated tax freezes would save Britain’s 30 million motorists £10 every time they filled up at the pumps.

It’s a typically oblique political claim; cutting a planned 0.5p-a-litre increase will not save a tenner for any motorist filling a typical fuel tank of, say, 50 to 60 litres. Rather, he’s referring to the planned five-year freeze on the fuel duty escalator, in real terms. But then this was very much a Budget of posturing and smoke and mirrors, as the May elections loom large.

Drivers living in rural areas may benefit from 5p-a-litre cuts, as a new countryside tax relief kicks in on 1 April 2015, the Budget also revealed today.

And Osborne announced further investment into autonomous cars and revealed Government plans to reduce the Severn road crossing toll from 2018, when it passes into public ownership.

Read on for a full analysis of the key automotive tax tweaks unveiled, with changes to fuel duty, car tax and other fiscal measures. We’ve got a full round-up of all the motoring news live from the 2015 Budget.

March Budget 2015 at-a-glance: how it affects motorists

Fuel duty

The Chancellor froze fuel duty, scrapping the proposed 0.54p-per-litre duty escalator due in September 2015. ‘I want to make sure that the falling oil price is passed on,’ said Osborne, who called the five-year amnesty the longest fuel duty freeze for two decades. He claimed that his move would save motorists £10 every time they fill up – or £675 a year by 2016, according to Whitehall estimates. Hauliers will do even better, saving an estimated £21,000 per lorry annually.

Cheaper petrol in remote areas

‘The government recognises that motorists in some rural areas face particularly high pump prices compared to the rest of the UK, and has now received full approval from the Council of the European Union to extend the rural fuel rebate scheme to 17 areas of the UK mainland, enabling retailers in eligible areas to register for a 5 pence per litre fuel duty discount.’ Will that be passed on to motorists? That is the key question…

Weak oil prices: impact on UK drivers

‘The fall in oil prices has supported household budgets,’ the Budget documentation explains. ‘Due to petrol pump prices falling by 19p per litre since March 2014, the cost of filling up a tank for the typical motorist has fallen by £11 since Budget 2014. The government has made very clear that it will watch industry to ensure that savings from the fall in oil prices are being passed through to consumers.’ Coalition politicians across Westminster must be relieved that oil prices have handily dropped just in time for the General Election, just 50 days away…

Road tax

Annual road tax will rise by inflation from 1 April 2015. ‘Vehicle Excise Duty (VED) rates for cars, vans, motorcycles and motorcycle trade licences will increase by RPI,’ the Budget confirmed.

Classic car tax

As earlier announced, the rolling deadline for classic car VED tax exemption will switch to apply to all cars registered before 1 January 1976. Great news for owners of old bangers. But will they continue to bring the cut-off forwards, to allow more modern classics tax-exempt status?

Investment in roads

The Budget includes an update on roads spending. ‘To improve the Strategic Road Network, 15 major schemes worth £3.4 billion have been completed with a further 16 schemes worth £2.3bn underway.’ The Government said roads planned for upgrades include the A1, M62, M1, A556 and Mersey Gateway Bridge – and a tunnel under Stonehenge (that old chestnut!).

Company car tax

‘Recent changes to the company car tax regime have supported the move to fuel efficient cars while ensuring that the benefit-in-kind is taxed fairly. The Budget announces that in 2019-20 rates for Ultra Low Emission Vehicles will increase more slowly than previously announced, and that rates for other cars will increase by three percentage points.’

Severn road crossing

In a surprise announcement, Osborne revealed that the toll for crossing the Severn bridge between England and Wales on the M4 would be ‘reduced’ from 2018. Some media are reporting the plan is to abolish it altogether, in the longer run. Great news for the ‘Welsh tax’ on the M4 westbound.

Investment in autonomous cars

A new £100 million investment was announced in autonomous car projects in the UK. The Government wants to make Britain a centre of excellence in driverless cars.

Car manufacturing

Osborne hailed the increase in manufacturing output, led by a buoyant car industry, and pointed to faster growth in the North than the South. ‘Britain’s manufacturing output has grown more than four-and-a-half times faster than it did in the entire decade before the crisis… We are seeing a truly national recovery,’ said the Chancellor. It’s worth noting that most of the UK’s volume car factories are based in the Midlands (Jaguar, Land Rover, Aston Martin) and the North (Nissan, Land Rover, Bentley).

Spending on transport

The Government commits to spending £29 billion as part of its public sector spending commitment 2015-16.

HGV drivers

The Budget spelled out measures to support Britain’s lorry drivers, to tackle the shortage of skilled staff available as foreign hauliers are dominating.

Electric vehicle support

‘The government announced in February 2015 the launch of a £10 million ultra-low emission vehicle (ULEV) battery prize, which will see a UK-based collaboration of manufacturers and researchers develop a new commercially viable battery pack for ULEVS. The winner will be announced in summer 2015.’

Motoring reaction to the 2015 Budget and changes to car tax

Company car drivers

‘The announcement that BIK rates will rise by 3% in 2019 makes it even more important for businesses to identify vehicles with low CO2 emissions that are both fit for purpose and attractive to drivers. Fortunately companies now have considerably more choice when it comes to reducing CO2 emissions. They should also consider new and alternative technologies, which will become increasingly available by 2019, as well as best in class traditional fuels.’

Andrew Hogsden, Lex Autolease senior manager, fleet consultancy

Hauliers

‘The Chancellor’s announcement today is the first confirmation from UK Government that charging will continue after 2018 when the bridge comes into public ownership. Whilst the change to the tolls is seen as good news for van and minibus operators, the Freight Transport Association considers it is a kick in the teeth for the logistics industry as a whole. There are three years of toll increases still to come. By 2018 we anticipate that the toll will be in excess of £20 for HGVs.’

Ian Gallagher, FTA Head of Policy South West and Wales

The opposition

The BBC

‘The electoral biscuit tin was out, and a few jammy dodgers offered to marginal constituencies, name checked here and there.’

Chris Mason, political correspondent, BBC News

The AA

‘With petrol and diesel prices surging and falling by more than 35p a litre since 2010, the continued four-year fuel duty freeze allows the Coalition to dodge the fuel-protest bullet.’

Edmund King, the AA’s president

Petrol price campaigners